India’s legion of financial influencers are once again under the spotlight as the country’s market regulator ramps up action against unregistered advisors dishing out investment tips on social media.

The Securities and Exchange Board of India last week barred Mohammad Nasiruddin Ansari and two other entities linked to him from the market and ordered them to refund 172 million rupees ($2.1 million) taken from followers. Ansari’s YouTube channel has close to half-a-million subscribers. His web portal provided investment advice under the guise of offering educational training, Sebi said.

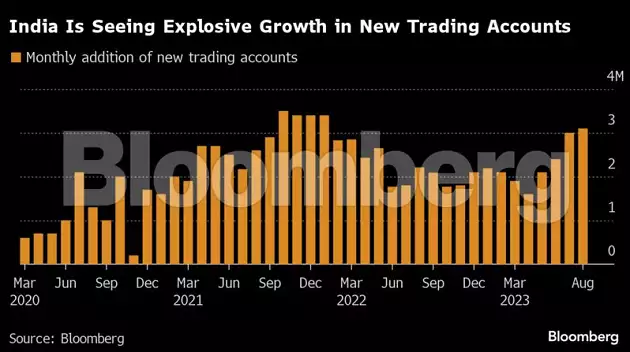

The regulator’s order is at least the third high-profile crackdown on a financial influencer this year. While retail trading boom during the Covid era has cooled in many parts of the world, the lasting rally in Indian equities since the depths of the pandemic has seen young investors turn to social media in droves for stock tips.

That’s led to a proliferation of influencers such as Ansari offering lessons on investing.

“You may see more actions coming from the regulator in appropriate cases as Sebi is watching over finfluencers and their conduct,” Manendra Singh, partner at Mumbai-based Economic Laws Practice said over phone. “The tussle between the influencer ecosystem and regulator will continue.”